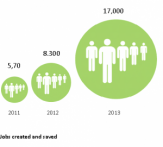

The impact of CDFIs has grown massively in recent years. The jobs created and saved thanks to CDFIs have more than doubled in just one year. Continue reading

Tag: Payday loans

Governnment to introduce interest rate cap

The government has announced that the cost of payday loans will be capped under a new law. In a surprise move, Chancellor George Osborne said there would be controls on charges, including arrangement and penalty fees, as well as on interest rates. Continue reading

New rules to tackle payday lenders, but where is the support for ethical alternatives?

FCA proposals to restrict practices of payday lenders are very welcome. We also need to invest in our communities and community lenders. Continue reading

The credit union payday loan

A new report has found that a credit union payday loan product could break even in the long-term and has proved very popular. London Mutual Credit Union has piloted the use of a payday loan product, funded through the Barclays Community Finance Fund and Friends Provident Foundation. Continue reading

CDFA welcomes church plans to put Wonga out of business

The Church of England plans to force payday lender out of business – by competing against it. CDFIs and credit unions provide the solution. Continue reading

Put your money on the high street

Our high streets don’t look like they once did. They’re now full of bookmakers, pawn shops and payday lenders. Continue reading

Families could save £2.1billion with ethical lenders

The seven million people currently using payday and doorstep lenders could save £2.1billion if they used ethical alternatives, according to new research released today. Community development finance institutions (CDFIs) are non-profit lenders that operate across the UK. Last year demand for their services more than doubled.

Continue reading

Payday lenders given 12 weeks to change their ways

The OFT has found widespread evidence of irresponsible lending and breaches of the law across the payday sector. The damning report, which follows a year long review of the £2bn sector, said too many people were being granted loans they could not afford to repay, and lenders’ revenues were heavily reliant on customers failing to repay their original loan in full and on time. Continue reading

Tackling Britain’s high cost credit problem

The Centre for Responsible Credit is holding a conference to discuss the latest developments in the high cost credit sector and consider what now needs to be done. Continue reading

CDFA welcomes future cap on payday lenders’ rates

CDFA has welcomed a Government commitment to amend the Financial Services Bill which will give the new financial regulator the power to cap interest rates on payday loans. Continue reading