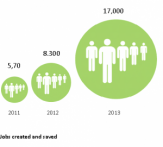

The impact of CDFIs has grown massively in recent years. The jobs created and saved thanks to CDFIs have more than doubled in just one year. Continue reading

Tag: CDFIs

Budget 2014

19.03.2014 George Osborne, the Chancellor of the Exchequer, delivered the Government’s 2014 budget, which included some welcomed news concerning support for social enterprises and small and medium sized enterprises (SMEs). The Chancellor’s speech highlighted the stronger-than… Continue reading

Bank disclosure of lending data provides “ideal opportunity” for mainstream banks to partner with CDFIs

The CDFA welcomes tomorrow’s disclosure of lending data at postcode level by the high street banks – and offers banks the opportunity of working with their members to reach hard to reach markets. Continue reading

Autumn Statement 2013

CDFIs can play a key role in delivering the growth, investment and employment that the Chancellor wants Continue reading

Change the message…

Ben Hughes examines how we can cut through the froth of the party conferences by spelling out how CDFIs are making a difference, and their £1.125bn contribution to GDP. Continue reading

The need for finance sector reform

Jennifer Tankard, Director of Community Development Foundation, explains why the Community Investment Coalition is working together for fair and affordable financial services for all.

Continue reading

Lending, lending, lending…

It’s been a busy time for our business-focused CDFIs. They’ve been posting record lending figures, helping more small firms than ever.

Banking the unbankable

More and more firms are slipping into the category of ‘the unbankable’. But there is light – and money – at the end of the tunnel for these businesses. Continue reading

Time to get ruthless?

Banks lend to the most profitable customers. CDFIs lend to customers that are seen as less-profitable, more-risky. They lend smaller amounts, they build relationships with customers and, in most cases, also provide support and advice. This could be giving money management advice to a customer, or helping a social enterprise with its business plan. It is these value added services that are a core part of the CDFI’s social mission, and a core reason why they are effective at helping enterprises and families.

Continue reading

Ethical lending on the rise as bank lending falls

New research from the CDFA shows that demand for CDFI loans has doubled in the last two years and has now hit almost £1 billion. Continue reading