Ben Hughes reflects on the forthcoming election and its implications for our industry. With the three main national parties having an evident commitment to at least some aspects of the work of CDFIs, can we look forward to a time of new hope and opportunity? Continue reading

Tag: cdfa

£6billion gap in finance for individuals and organisations outside mainstream finance

Unmet demand for finance amongst individuals and organisations that do not qualify for traditional bank funding has reached more than £6billion, according to new research published today by the Community Development Finance Association (CDFA), supported by RBS Group. Continue reading

CDFA welcomes future cap on payday lenders’ rates

CDFA has welcomed a Government commitment to amend the Financial Services Bill which will give the new financial regulator the power to cap interest rates on payday loans. Continue reading

Government commits to disclosure of ‘postcode level’ lending data

The Government has made a commitment to collate and publish bank lending data on a postcode-level basis – and says legislation will follow if “negotiations with industry fail to deliver.” Continue reading

Demand for Community Finance soars as ethical lenders take on the Wongas

04.10.2012 Enquiries to ethical ‘community finance’ providers have more than doubled in the last year as individuals seek routes out of high interest debt traps, according to new figures released by the CDFA today. Continue reading

Banking Reform proposals do not adequately support economic growth

07.09.2012: The UK’s banks need to re-focus on the core business of ‘lending to the real economy so as to contribute to balanced and sustainable growth’ according to a submission to the Banking Reform White Paper, issued today. Continue reading

£80bn scheme a missed opportunity for businesses who won’t see a penny

The government has missed a vital opportunity to help the most vulnerable businesses in the UK, said CDFA’s Ben Hughes today, adding “small local businesses starved of bank finance won’t see a penny of this fund.” Continue reading

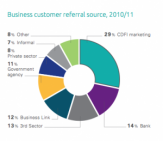

CDFIs fill the finance gap for businesses in need

By investing in businesses in disadvantaged communities or struggling to access mainstream credit, CDFIs help to bring employment opportunities and needed services to deprived communities. Continue reading

DWP investment “to secure future of credit unions” and other social lenders

CDFA’s Ben Hughes welcomes investment into the social lending sector – but says more is needed to reach all communities across the UK. Continue reading

As Startup Loans are Go!, CDFIs can help – and can Make Business Your Business

CDFA’s chief executive Ben Hughes today welcomed a new package of loan finance and mentoring for young people wanting to start their own businesses – and said community finance providers are logical delivery partners for the scheme.

And CDFIs feature within a new report on supporting start-up and small business development by the Prime Minister’s enterprise adviser, Lord Young, which was launched today. Continue reading