The UK is one of the most powerful financial centres in the world, yet financial exclusion remains a significant issue. At the same time, a recent report into racial prejudice in Britain today shows that despite… Continue reading

Tag: alternative finance

Responsible finance is the only real alternative to predatory lending

05.02.2018 This week the FCA published an update on its work in the high cost credit market. A fuller picture of the FCA’s position and potential interventions in the rent to own, home credit, catalogue… Continue reading

CIC Blog: tackling financial exclusion in Scotland

Using data to understand and tackle financial exclusion in Scotland – summary of a round table discussion in the Scottish Parliament, hosted by Social Investment Scotland (SIS) and the Community Investment Coalition (CIC) On a… Continue reading

Green, gourmet and graveyard businesses announced as finalists for Microentrepreneur of the Year Award

A renewable energy firm, a luxury chocolate shop and an innovative management system for graveyards are among the businesses announced as finalists for this year’s UK Citi Microentrepreneurship Awards. The national awards scheme celebrates innovative and growing businesses that have taken off with the help of alternative finance from community lenders (known as CDFIs). Continue reading

A new ecosystem for business funding-the rise of alternatives

Adam Tavener examines the growth of alternative finance and explains why he set up Alternative Business Funding to help SMEs Continue reading

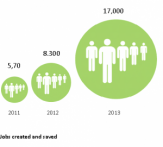

Creating more jobs than ever before

The impact of CDFIs has grown massively in recent years. The jobs created and saved thanks to CDFIs have more than doubled in just one year. Continue reading

Banking the unbankable

More and more firms are slipping into the category of ‘the unbankable’. But there is light – and money – at the end of the tunnel for these businesses. Continue reading

Demand for non-bank business loans increases

Non-bank community lenders saw an increase in demand from businesses of 36% in the first quarter of 2013, according to the Community Finance Monitor survey. This bucks the trend reported in today’s Bank of England Trends in Lending report, which says demand for bank credit remained weak in quarter one, and that demand from small businesses fell. Continue reading