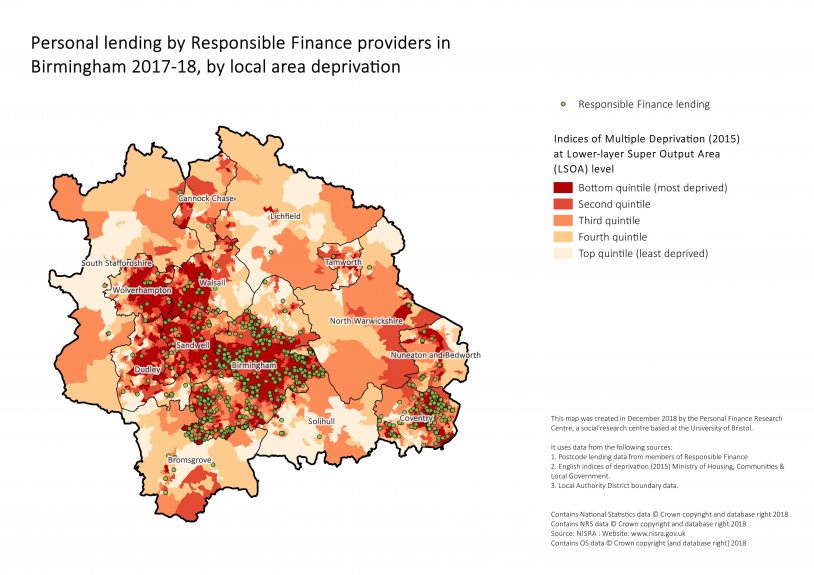

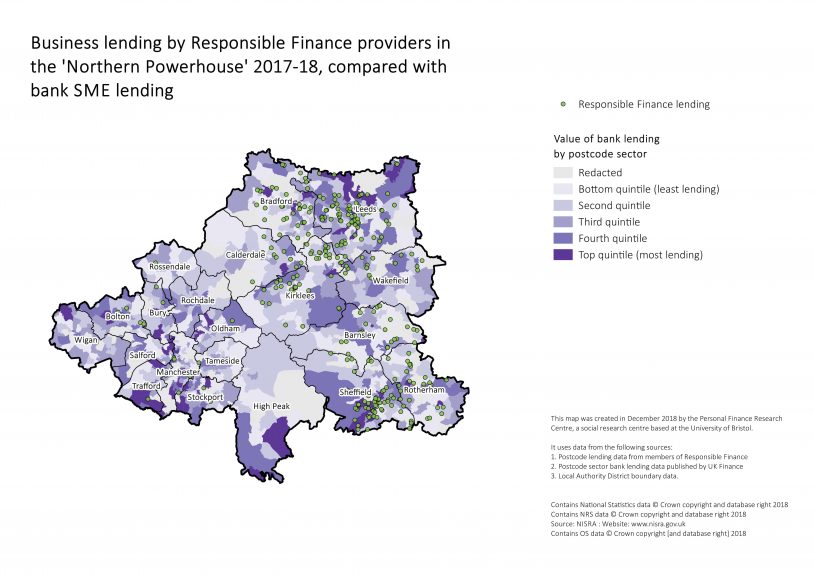

Business lending – getting finance to where it is most needed

Responsible finance providers have a flexible approach in determining the viability of a business and a different risk appetite to banks which allows them to lend to business who are otherwise excluded. Responsible finance business lending data has been mapped with bank SME lending data and geographies of deprivation in the Northern Powerhouse region (using responsible finance lending data, UK Finance’s bank lending data, and the 2015 English Indices of Multiple Deprivation). Figures 1 and 2 demonstrate that responsible finance loans are made in areas where there is less bank lending and higher levels of deprivation.

Figure 1

Figure 2

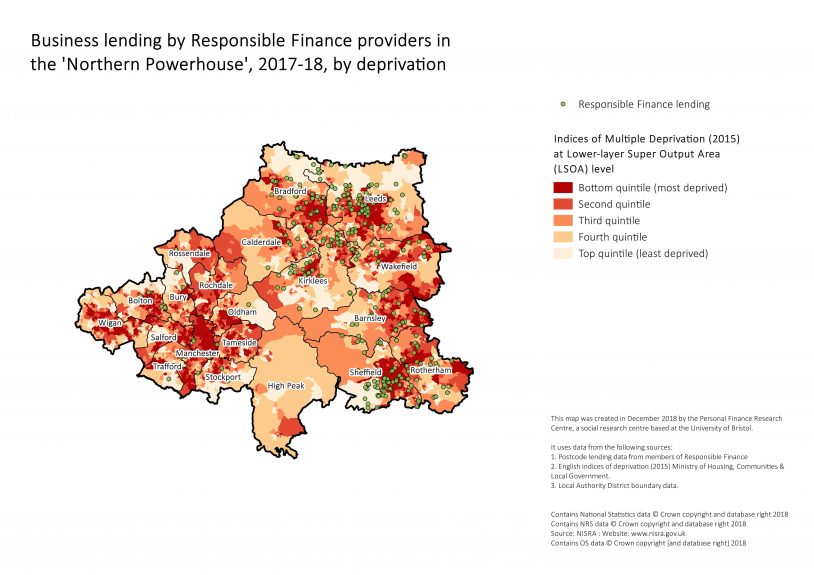

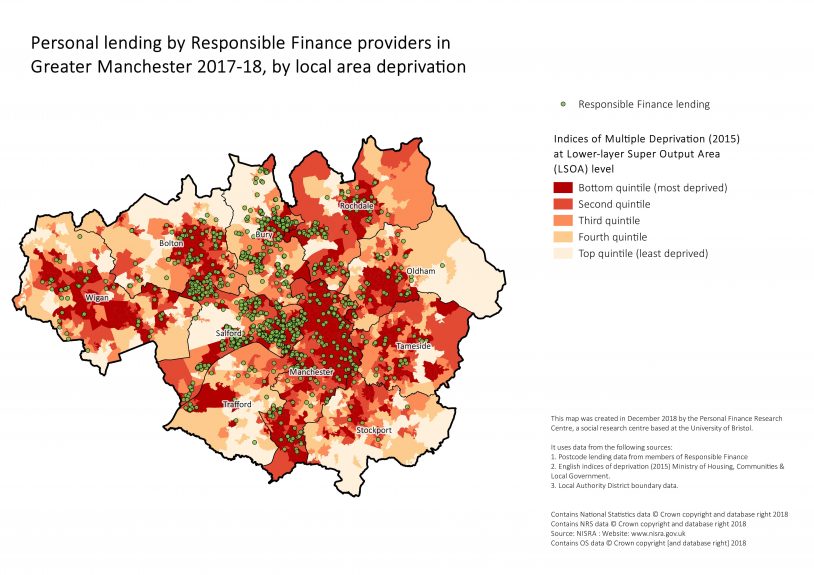

Personal lending – reaching the financially excluded

Across the country there are pockets of poverty and deprivation. Responsible finance providers are lending to individuals in these areas who are unable to access other forms of affordable finance. Responsible finance personal lending data has been mapped with geographies of deprivation in the Manchester and Birmingham regions (using responsible finance lending data, UK Finance’s bank lending data, and the 2015 English Indices of Multiple Deprivation). Figures 3 and 4 show that responsible finance lending is clustered in the most deprived areas of the Greater Manchester and West Midlands regions.

Figure 3

Figure 4