"A lifeline

when I needed it"

NatWest Group and Responsible Finance Hardship Grant Programme

“At the moment I am waiting for my job to start, however I do not have a single penny to my name, nor do I have savings. I simply needed the money to get me through my essentials until I get my first pay from my new job.”

A rapid response to urgent need

Nearly a quarter of households are struggling to pay for food and other essentials[1] because of the cost of living crisis. Over 5 million adults are in financial difficulty, a 33% jump since last year[2]. And “business has never been so good” for loan sharks[3].

The NatWest Group and Responsible Finance Hardship Grant Programme was designed to help financially vulnerable households. We distributed no-strings-attached grants of £50 to £100 to people who had applied to a not-for-profit lender for a small-sum loan but were turned down.

Small sums of money can make a huge difference: imagine what happens next when someone needs to borrow a couple of hundred pounds but can’t. Perhaps there’s no food on the table. Perhaps they approach an illegal lender.

The grants have helped people feed their children, pay their energy bills, replace broken appliances, and carry on getting to work. They’ve been an immediate lifeline for more than 4,000 households. Some recipients told us that without the grant they would have resorted to borrowing from loan sharks.

Community Development Finance Institutions (CDFIs, our members) have a long history of helping financially excluded and vulnerable people. They operate for social purpose, not profit. They lend fairly and at affordable rates to people who can’t borrow from banks and other lenders, but only if it’s right for the person – they say no to most people who apply to borrow. But they support applicants and customers in lots of other ways.

When NatWest Group wanted to increase their support for communities, CDFIs used their infrastructure to get the funding and support straight to those who needed it most.

4,049 hard-pressed households received £416,600 in grants from CDFIs through the programme, which was covered positively by The Financial Times, The Guardian, New Start magazine and other media. This is the programme impact:

[1] Personal Finance Research Centre: The ‘new normal’? The financial wellbeing of UK households, May 2023.

[2] Financial Conduct Authority: Financial Lives, January 2023.

[3] Newsnight and Fair4All Finance, June 2023

£416,600 rapidly delivered to meet urgent need by 6 CDFIs

What have the grants been used for?

-

27% Food

-

23% Bills and utilities

-

10% Appliances and furniture

-

8% Housing costs

-

5% To repay existing debt

-

27% Other

"These funds are really helping put food on the table, help transport to work, help with carers."

What impact have

the grants had on people's lives?

“I just wanted to thank you from the bottom of my heart”

Fridge essential for medication and food

Kids get ‘full bellies’ in school holidays

A fix for Jared’s washing machine

Hospital taxi costs stretched Zadie to limit

Grant helps domestic violence survivor rebuild

NHS worker is roadworthy with tyre bill covered

Nicola needed a washing machine

Helen’s grant keeps electricity and gas on

Grant helps Biockson recover from surgery

Part-time work leaves Anisah’s budget stretched

Who did we reach?

-

62% Female

-

25% Black, Asian or other ethnic minority

-

90% age 25 - 64

-

33% living in social housing

-

33% living in a private rental

-

16% living with friends and family

-

50% benefits income recipient

-

66% employed

-

72% with an income under £21,301

-

20% Living with a disability

-

32% Lone parent with dependents

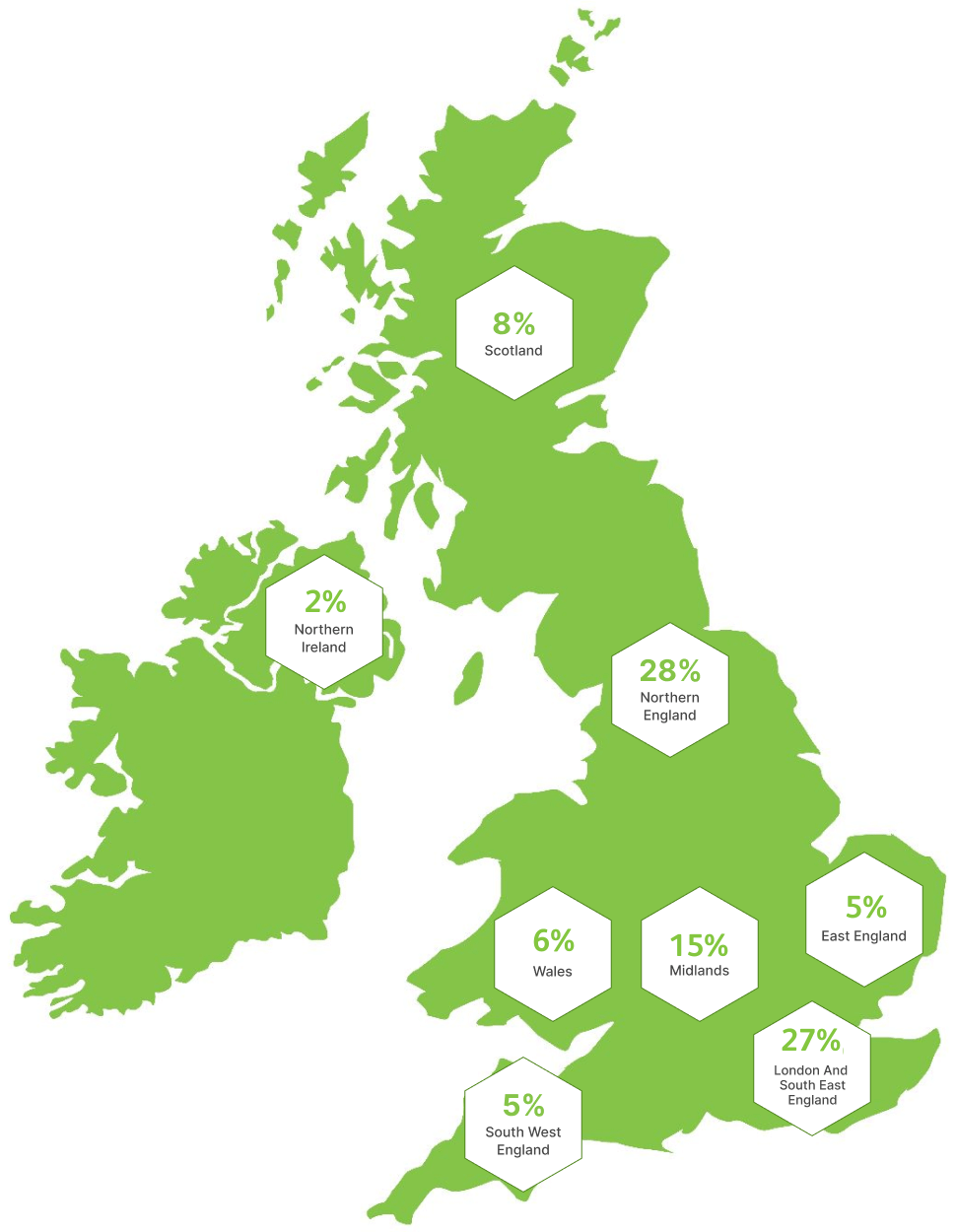

Where are the people we’re reaching?*

* % of total grants distributed by region.

CDFI Delivery Partners:

“People have been really grateful because they have been struggling with the cost of living and the £100 has been such a relief, especially as it’s something they don’t have to pay back. Some have used it to pay utility bills, for funeral expenses or other debts they had no way of paying, others to put food on the table.”

Izuka Nnabundo

To learn more about the CDFI sector you can read Responsible Finance’s impact report here.

If you are interested in partnering with the CDFI sector on similar projects please get in touch.