Ground breaking research conducted in Leicester by the Centre for Responsible Credit (CfRC) has demonstrated that bank lending data analysis can provide critical intel about the fragility of local economies. ‘The Distribution of Consumer Debt in Leicester’ calls for more data about household debt to enable detailed mapping at the local level.

In 2013, the British Bankers Association (BBA) and Council of Mortgage Lenders (CML) entered into a voluntary framework to disclose bank lending data across Great Britain. This was an unprecedented and welcome step towards greater transparency amongst the UK’s retail banks. It made the UK’s financial services markets the most transparent in the world, after the USA. The voluntary framework for data disclosure was one of many responses to the 2009 banking crisis. It aimed to address the lack of competition in the banking sector by highlighting under-served markets and so potential markets for new entrants or opportunities for responsible finance providers to expand their reach. It was hoped it would support financial inclusion by supporting more targeted intervention.

So three years on from the launch of the voluntary framework what have we learnt from the data? Broadly, that the main retail banks lend less in areas of lower income. But more information is needed before we can begin to draw useful conclusions from the data. For example, the level of lending is expressed as an overall figure. While it is possible to simply divide this figure by the local population to get a per capita number, it isn’t possible to tell immediately just how many loans are disbursed and to whom. Nor can we see how many loan applications are denied.

Research published by Coventry University and Newcastle University in November 2014 highlighted the limitations of existing data releases. It was possible to deduce that as deprivation increases in an area personal lending declines, with the same trend evident in business lending. The researchers pinpointed a number of ways the data could be supplemented or tweaked to facilitate much more useful analysis.

For a start, using postcodes as the basic geographical boundaries by which the data is segmented makes it tricky to compare with other datasets collected using different a different zonal scale. Grouping into Lower-layer Super Output Areas (LSOA) or Middle-layer Super Output Areas (MSOA) would make for much easier comparison with other important indicators. Even with this adjustment, the most nuanced interpretation of the data is arbitrary and inexact in estimating the factors behind disparities in lending. More specific information is needed on the number of transactions, including: declines; individual loan amounts; markers of cost of loan release; and characteristics of the borrower (e.g. gender, ethnicity) or business (e.g. turnover, employment, legal form).

‘The Distribution of Consumer Debt in Leicester’ analyses the data in the Leicester Local Authority area, to support local financial inclusion activity. It combined the bank lending data as closely as possible with census data and estimates related to household debt and deprivation in Leicester.

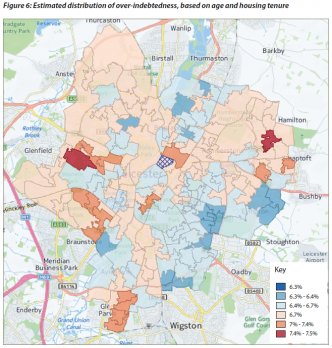

Through a process of systematically layering one dataset onto another, the resultant report visually maps out trends in consumer credit debt across Leicester: estimating the numbers of debtors in each LSOA and their average level of debt; mapping debt-to-income ratios; estimating over-indebtedness; mapping the impact of individual lenders (Barclays, Lloyds Banking Group, HSBC, RBS, Nationwide); and finally estimating the number of children living in debtor households.

One key finding is that simply dividing debt by the number of people or households in a given area is unlikely to indicate where the level of debt is a critical problem and intervention needed. When likely debt-to-income ratios are calculated, a different map emerges.

But even working out accurate debt-to-income ratios, stopping short of deeper analysis (e.g. of lending trends based on borrower characteristics), more complete data is need. Credit card debt, payday lending firms, overdrafts, and other forms of consumer credit are missing. These make up a large portion of the debt in low income communities. Unfortunately the lending data sets of Santander, Yorkshire Bank and Clydesdale Bank, were not locatable on their websites at the time the report was written. The report calls for the BBA to work closely with CIC to make data available of sufficient quality and granularity to help support financial inclusion.

Significant concerns about competitiveness in the UK’s banking sector remain. CIC calls for the Financial Conduct Authority (FCA) to command full disclosure of data as a means to support analysis of market competition for low income households. The FCA has a mandate to promote competition in financial services and the power to take action. Identifying underserved markets would enable responsible finance providers to step into the breach and ensure competition to provide affordable credit to low income consumers.

At a time when household debt levels are causing significant concern, those seeking to tackle this and support broader financial inclusion need accurate and timely data to target effective intervention. This data is also critical to supporting competition and allowing responsible finance providers to scale up to meet the challenge of access to finance in low income communities.

Jennifer Tankard

Director, Community Investment Coalition

http://responsiblefinance.org.uk/cic/

Link to the full report: http://responsiblefinance.org.uk/report-the-distribution-of-consumer-credit-debt-in-leicester/

The research was funded by Local Trust and delivered by Damon Gibbons at the Centre for Responsible Credit on behalf of the Community investment Coalition.