10.09.2012 A new revolving fund of £500,000 has been launched to help underwrite community share issues. Continue reading

Category: News

UK business: ambitions up, capital down, says survey

08.09.12 The Investec Entrepreneur Confidence Index shows encouraging ambitions for business growth – but found that only six per cent of respondents to a survey expected accessing capital for their growth plans to be easy. Continue reading

Banking Reform proposals do not adequately support economic growth

07.09.2012: The UK’s banks need to re-focus on the core business of ‘lending to the real economy so as to contribute to balanced and sustainable growth’ according to a submission to the Banking Reform White Paper, issued today. Continue reading

New figures show collapse in bank lending, and unsung heroes filling gaps

The Bank of England’s latest Trends in Lending report (pdf) has confirmed that lending to UK businesses fell by £3bn in the three months to May, with small and medium-size enterprises (SMEs) especially hard hit. Continue reading

£80bn scheme a missed opportunity for businesses who won’t see a penny

The government has missed a vital opportunity to help the most vulnerable businesses in the UK, said CDFA’s Ben Hughes today, adding “small local businesses starved of bank finance won’t see a penny of this fund.” Continue reading

Dave lends where banks don’t – just like CDFIs

He likes bananas and he’s not a fan of banks. So plain-speaking David Fishwick decided he wanted to launch a bank with a difference. A new 2-part series on Channel 4, which began last night, told his story. Continue reading

CDFIs a lifeline for 21,000 households – saving many from loan sharks

Consumer loans from CDFIs have increased by 35% in the last financial year Continue reading

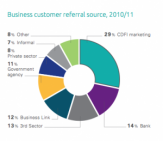

CDFIs fill the finance gap for businesses in need

By investing in businesses in disadvantaged communities or struggling to access mainstream credit, CDFIs help to bring employment opportunities and needed services to deprived communities. Continue reading

DWP investment “to secure future of credit unions” and other social lenders

CDFA’s Ben Hughes welcomes investment into the social lending sector – but says more is needed to reach all communities across the UK. Continue reading

1 in 8 workers using payday loans – and losing three days’ wages

Workers are increasingly using payday loans because their wages run out before the end of the month, according to a new report published by the union Unite. Continue reading