Ben Hughes discusses why we need better financial services, the CDFA’s vision for Just Finance for all and how we plan to achieve it. Continue reading

Category: News

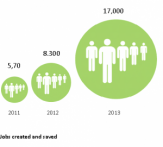

Creating more jobs than ever before

The impact of CDFIs has grown massively in recent years. The jobs created and saved thanks to CDFIs have more than doubled in just one year. Continue reading

Budget 2014

19.03.2014 George Osborne, the Chancellor of the Exchequer, delivered the Government’s 2014 budget, which included some welcomed news concerning support for social enterprises and small and medium sized enterprises (SMEs). The Chancellor’s speech highlighted the stronger-than… Continue reading

Top microenterprises rewarded with £65,000 in national award scheme

Organisations and individuals recognised for impact they have had in communities across the UK Champions of locally-based finance for microenterprises rewarded at 12th February Awards Ceremony in Bristol, featuring BBC Breakfast’s Steph McGovern [Image: Steph McGovern… Continue reading

Bank disclosure of lending data provides “ideal opportunity” for mainstream banks to partner with CDFIs

The CDFA welcomes tomorrow’s disclosure of lending data at postcode level by the high street banks – and offers banks the opportunity of working with their members to reach hard to reach markets. Continue reading

Autumn Statement 2013

CDFIs can play a key role in delivering the growth, investment and employment that the Chancellor wants Continue reading

Governnment to introduce interest rate cap

The government has announced that the cost of payday loans will be capped under a new law. In a surprise move, Chancellor George Osborne said there would be controls on charges, including arrangement and penalty fees, as well as on interest rates. Continue reading

New rules to tackle payday lenders, but where is the support for ethical alternatives?

FCA proposals to restrict practices of payday lenders are very welcome. We also need to invest in our communities and community lenders. Continue reading

Change the message…

Ben Hughes examines how we can cut through the froth of the party conferences by spelling out how CDFIs are making a difference, and their £1.125bn contribution to GDP. Continue reading

The need for finance sector reform

Jennifer Tankard, Director of Community Development Foundation, explains why the Community Investment Coalition is working together for fair and affordable financial services for all.

Continue reading