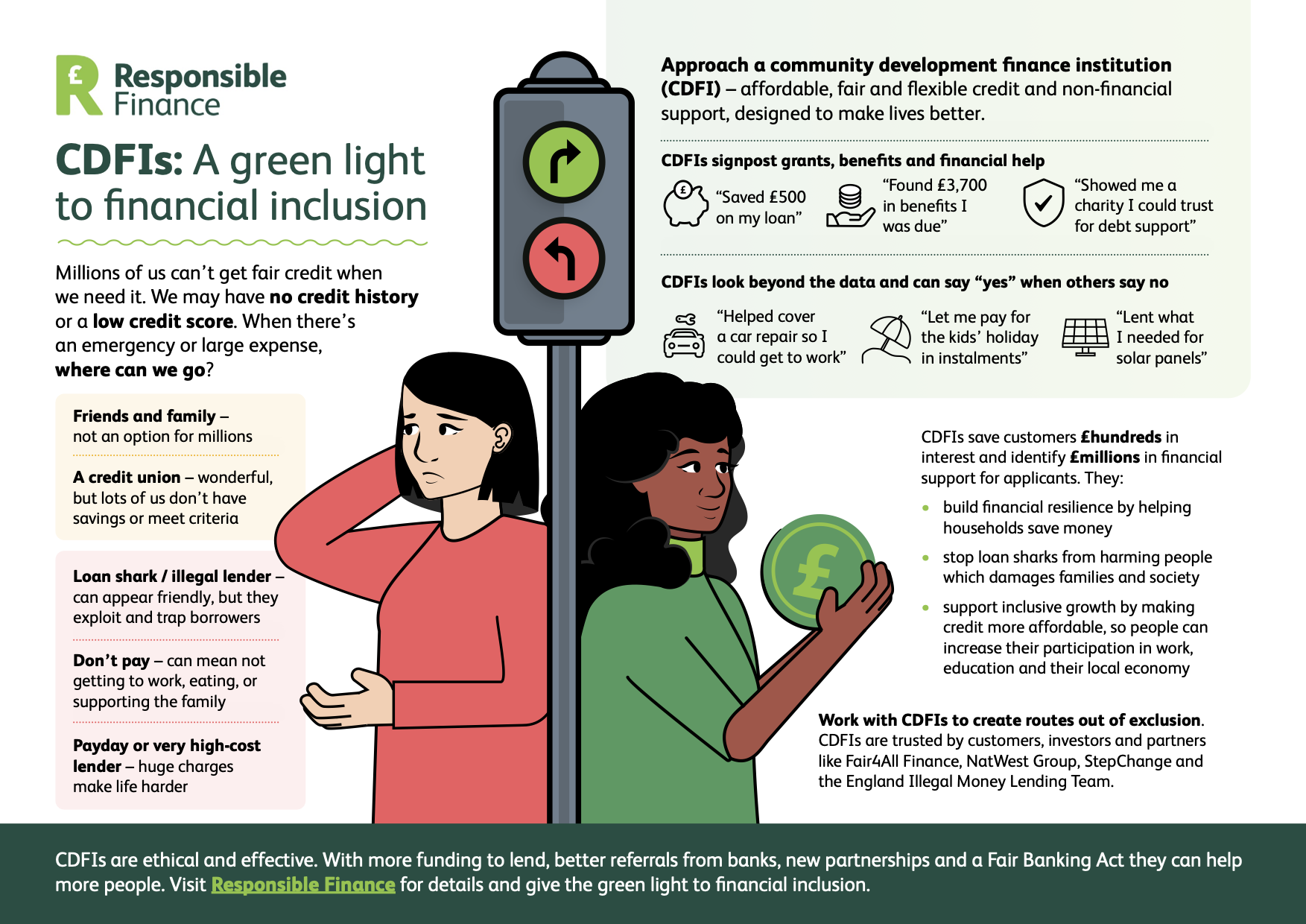

Millions of us can’t get fair credit when we need it. We may have no credit history or a low credit score. When there’s an emergency or large expense, where can we go?

- Friends and family – not an option for millions

- A credit union – wonderful, but lots of us don’t have savings or meet criteria

- Loan shark / illegal lender – can appear friendly, but they exploit and trap borrowers

- Payday or very high-cost lender – huge charges make life harder

- Approach a community development finance institution (CDFI) – affordable, fair and flexible credit and non-financial support, designed to make lives better

Our infographic and carousel explains how CDFIs build financial resilience by helping households save money, stop loan sharks from harming people which damages families and society, and support inclusive growth by making credit more affordable, so people can increase their participation in work, education and their local economy

Download the infographic (pdf) and use it to help explain CDFIs’ impact: