30 June 2023: Niall Alexander, Markets and Consumer Insights Manager, Fair4All Finance, on shocking research findings, a new report, and why it’s critical to expand community finance and for policy makers and mainstream banks to accept we must address the ‘credit vacuum’.

At Fair4All Finance our task, in part, is to increase the availability of credit to people in financially vulnerable circumstances. An important way of doing that is to support the scaling up of community finance lenders, like CDFIs and Credit Unions. That’s one of the reasons why we’ve invested over £23 million in four Responsible Finance members.

We believe CDFIs and many credit unions, like Great Western and London Mutual, have a proven record of getting money into the hands of households, delivered with excellent wraparound services, and fantastic customer care.

Currently, lenders and borrowers face significant difficulties post pandemic, and through a cost-of-living crisis. Challenges in lending and recovering small loans, manifest in higher declines and arrears. Pressures on tightened budgets, and increases in food, energy and rent, making borrowing difficult with more applicants failing affordability assessments.

However, there’s a displacement gap between how much money can be lent by community finance in all its guises, (Responsible Finance reported £46m+ of [personal] lending from CDFIs in 2022; within Britain’s credit unions the volume of outstanding loans has doubled to £1.3billion in a decade) to meet the demand for credit sought by borrowers increasingly credit starved and declined from the mainstream and high-cost credit. JRF reported in June that “of those who applied for a loan, 2.8 million low-income households report having been declined lending between May 2021 and May 2023”.

The retreat of high-cost, short-term credit (HCSTC), home credit and rent to own (RTO) in recent years has led to a seismic shift in credit availability. Some lenders’ practices were shoddy, predatory and needed eliminating, but without available and accessible alternatives, millions of (mostly) poorer households are unable to meet unexpected but necessary outlays, and have (mostly) meagre savings to draw on, and a limited and reducing ability to make do or go without.

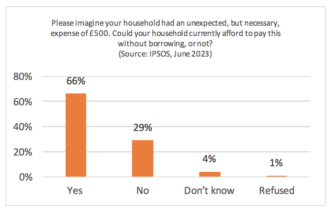

Ipsos research for Fair4All Finance* shows nearly three in ten 18-75 adults in Great Britain state their household couldn’t afford an expense of £500 without borrowing.

A decade ago, the FCA reported that HCSTC lent £2.5bn; Home Credit £1.2bn and RTO £0.9bn. Now, these three sectors lend around £500m collectively**, a 90% drop.

In the interim we’ve seen the rise of BNPL, and the continued use of overdrafts and credit cards (where 12-month growth rates are at their highest since 2005, according to Bank of England statistics), but these products are predominantly utilised by owners, the wealthier and those with good credit scores.

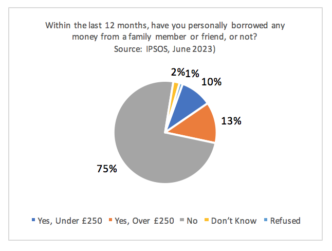

Friends and family borrowing continues to increase, but it can be finite. Ipsos research for Fair4All Finance* showed over one in five (22%) 18-75 year olds borrowed within the past 12 months.

A danger exists of a credit vacuum developing, and if it does, then who is going to lend to lower-income households?

Last year, we commissioned two pieces of research to understand whether this credit vacuum is developing and to ascertain, if it is, what is happening both across communities and within households. One research project interviewed nearly 300 people across four towns and cities in Great Britain, people with direct experience of borrowing illegally. They also interviewed eight illegal moneylenders.

Separately, as part of our second piece of research, Ipsos undertook an online survey of people aged 18-75 to see amongst other things how they are managing financially, what they are searching for online to meet their credit needs and whether they, or someone in their household had used an unlicenced or unauthorised informal money lender or loan shark. This detailed research will be published in September alongside an analysis of international models where illegal lending has filled similar credit vacuums.

Within our lived experience report, titled “As one door closes…” by We Fight Fraud, we discovered that it was low income working people, previously using home credit and other non-mainstream lenders who were phlegmatically using illegal lenders. “He’s just the money man.” People working full time, on incomes of £20,000 to £25,000, invariably renting, borrowing for Christmas, day-to-day essentials, and household bills. Fewer than 1% of those interviewed had reported themselves as victims of illegal lending.

Some of the lenders were former home credit agents, operating so called parallel lending, others were running legitimate businesses alongside illegal lending activity. All were well known within communities.

People are borrowing a few hundred pounds on opaque terms, with a pervasive undercurrent of violence and intimidation, although our researchers found few examples of actual violence, the threat seemingly enough. What they discovered was widespread fraudulent activity, money muling and money laundering.

In our Ipsos survey we examine:

• the behaviour of households dealing with a cost-of-living crisis and credit declines,

• the need for credit,

• the ability or inability to find £350 or £850 for emergency expenditure,

• the search terms used online to identify someone who will lend to them, and

• whether they, or someone in their household had used an unlicenced or unauthorised informal money lender or loan shark.

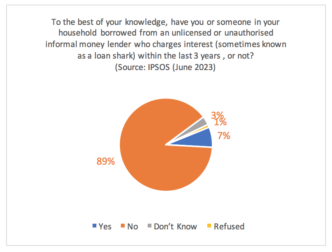

As our second piece of research is being finalised, we chose to run a series of further questions in June 2023. Ipsos undertook an online survey amongst a representative quota sample of GB adults aged 18-75. 7% said that to the best of their knowledge, they or someone in their household has borrowed from an unlicensed or unauthorised informal money lender who charges interest (sometimes known as a loan shark), within the last three years.

From the research in “As one door closes…” we made seven recommendations, including:

• More resources for the illegal moneylending teams

• an acceleration toward alternatives including community finance

• greater consideration on what mainstream banks can and should do including

• banks looking for signals of illegal lending activity among at risk customers

• credit building products

• further research on the subject and

• credit broking exemptions extended to other charitable and third sector organisations who can support people toward community finance

All of our work, published and unpublished, and that of other organisations highlights to us the critical nature of both expanding community finance but also too of having policy makers and mainstream banks accept that there is a danger of a credit vacuum, and that this is an issue that needs to be addressed by multiple stakeholders otherwise there is a danger of real harm being inflicted upon households and communities.

*Ipsos UK conducted an online survey amongst a quota sample of 1,859 adults aged 18-75 in Great Britain. All provided explicit consent for data to be collected regarding their household and personal finances. Fieldwork was conducted online between 16th – 19th June 2023. Data have been weighted to the known representative proportions for age and working status within gender, and for social grade, Government Office Region and education (graduate/non-graduate), to reflect the offline population of GB adults aged 18-75. All polls are subject to potential sources of error.

**FCA PSD006 dataset for Fair4All Finance and estimation by Fair4All Finance of current RTO market.

What next?

- More than 3 million may have borrowed from illegal moneylenders – new report urges boost to community lending sector

- Watch the BBC’s Newsnight programme from 28 June 2023. A segment from 13:28-24:18 includes interviews with illegal moneylenders – “business has never been so good” – and with Fair4All Finance CEO, Sacha Romanovitch OBE.

- Read this Financial Times article by Helen Thomas about the rise in use of illegal lenders, the gap in provision of affordable credit, the need to scale community lenders including CDFIs, and the potential impact of a Fair Banking Act.

- Read our piece from 2022, The sharks’ feeding frenzy and how to starve them.