According to Michael Gove levelling-up means boosting local leadership, raising living standards, improving public services and giving people necessary resources. The Communities Secretary said last week every government department will be a “department for levelling up,” and gave Teeside as an example of levelling up in action.

It put meat on the bones of a policy priority which had been criticised as either meaningless, or meaning “all things to all people” – perhaps reflecting the challenge and complexity of addressing entrenched regional inequalities. Politicians and policymakers are united in agreement that people in different parts of the country experience differences in opportunity, while differing in their proposed solutions.

It’s not right that some communities are starved of assets others take for granted. A fit-for-purpose infrastructure and transport system. Enough good quality, affordable housing. Civic engagement and pride. Well-paying jobs. Education and further education which equips people to live fulfilling lives.

And access to finance: too many businesses, people and places have long been unable to secure the money they need, with parliamentarians saying this is one of the biggest barriers to the government’s ambition to “level-up” and address regional inequalities.

Try to lift a boulder on your own and you’ll struggle. Set up a pulley or a lever system and you can magnify the impact of the same effort. Getting investment into under-served communities is so important we believe it’s the lever which multiplies the levelling-up impact. We must address the woefully inadequate availability of affordable, fair finance, so communities are powered-up for the long term. Otherwise, levelling-up is like lifting a heavy rock off the ground alone: you can hold it in the air for a moment, but it’ll soon drop back to the ground.

What levelling up could look like:

- Small businesses thriving, growing, investing in research and development, and creating job opportunities in all regions. Like the Cornish pasty maker which has grown from 12 to 96 employees and played a crucial part in feeding families who were struggling this year, or an innovative laser technology company in Doncaster expanding its manufacturing premises, and supplying to Rolls Royce and Siemens.

- Communities brimming with social enterprises delivering services which meet their needs, benefit the community and employ and train people who are marginalised. Like serving good quality meals made from surplus food to children in a deprived area of Glasgow, or employing young people with autism and training them so they can go on to get work and proposer.

- People on low or unpredictable incomes who don’t have the flex in their day to day budgets no longer using their limited disposable income to cover extortionate interest costs. Like a single parent looking to replace a broken washing machine and getting an affordable and flexible loan; meaning they save money and don’t need to juggle childcare with going to the laundrette.

Community Development Finance Institutions (CDFIs) make outcomes like this a reality every day – and without them, thousands of places, businesses and people would not have had access to opportunity.

CDFIs enable people to grow businesses which create great jobs. They back social enterprises which predominately work with and employ the most deprived people. They empower individuals to be in control of their financial wellbeing. And they work where mainstream and so-called challenger finance can’t or won’t go.

Enterprise

Every year over 200,000 viable and established small businesses, especially those led by Black and Minority Ethnic entrepreneurs, women, and people outside London and the south-east, can’t get the finance they need to grow. Banks make lending decisions using ‘hard information’ like credit scores, to be able to lend large volumes at scale. Their algorithms cannot consider ‘soft information’ such as local market knowledge and personal interaction with the management team. The effect of this is felt most acutely by deprived areas and for demographics who lack collateral, such as women and ethnic minority led businesses. 4 in 10 of all loan applications by SMEs are unsuccessful[1], and nearly 1/5 of SMEs cite access to finance as a major obstacle to growth[2].

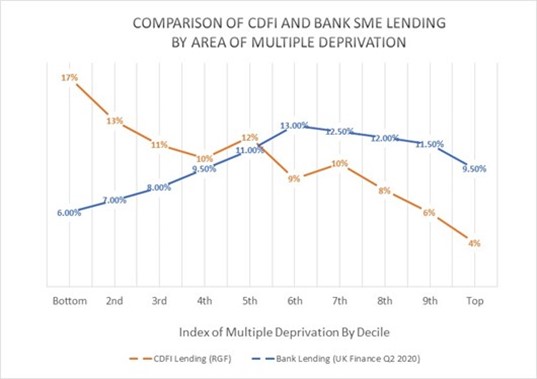

CDFIs ‘get their hands dirty’ and get to know the businesses and social enterprises they support, enabling them to go where other lenders can’t. 9 in 10 of the viable businesses they lend to have been declined by a bank, and 90% of these go on to thrive and repay their loan. Unlike banks they specifically focus their lending in areas of higher deprivation:

This helps tackle regional imbalances by giving businesses in these areas the opportunity to create jobs and grow, putting small businesses back into high streets, creating wealth that is retained locally.

People

Over the course of 2020 the number of adults with low financial resilience – meaning having low savings, low or erratic earning or are over-indebted – grew from 10.7 million to 14.2 million; equivalent to 3 times the population of Scotland[3]. These individuals are often excluded from the finance they need to level-up their circumstances.

People on low-incomes who don’t have savings often need access to small short-term loans to cover things like car repairs, replacing broken appliances and for special occasions like Christmas. They lack flexibility in their day to day budgets to be able to cover these bulky extra expenses, but can still afford to make repayments over a few months. As they often won’t be able to access bank products such as overdrafts and credit cards because of their income level and more unstable credit histories, they look for alternative sources of credit.

CDFIs offer people who are excluded from bank finance a lower cost lifeline. A typical loan of £500 from a CDFI can save someone £250 in interest compared to what they would pay a high-cost lender. That might be the difference in someone being able to heat their home. So called “subprime” borrowers – lower-income families, gig-economy workers, freelancers, carers, people looking for work – represent a big part of our population. Giving them a fair chance to succeed means they can use their savings on interest to slowly build their wealth and improve their quality of life. When not dealing with acute financial stress and problem debt, individuals’ health, mental health, education and employment outcomes are better.

Very big and very small

CDFIs lent £300 million to 40,000 customers from 2019-20, giving a whole stadium full of people and enterprises access to opportunity. Without us, thousands of places, businesses and people would not have had access to opportunity. This means lower wealth, lower local spending and reduced wellbeing leading to worsening geographic and socioeconomic disparities. But one stadium isn’t enough: millions of people and hundreds of thousands of enterprises were left without a ticket.

We’d love to help. In America, Government and companies invest into CDFIs to reach, empower and unlock the potential of the most under-served communities. They’re the critical lever for levelling-up there, and US secretary of the Treasury Janet Yellen has said “The questions ‘who can access credit and capital? And who can’t?’ are at the root of many long-term structural problems in our economy.”

Michael Gove, Rishi Sunak and their departments should take note of Yellen’s support for, and investment in, CDFIs. We’ve submitted a fully costed and evidenced proposal to the Spending Review which would return £8 of economic benefit for every pound spent and make levelling up a reality.

More investment from CDFIs is imperative for helping the regions of the UK to reach their potential. We must recognise that levelling-up the East End of Glasgow will not look the same as levelling up a seaside town on the South Coast of England; though both are equally as important. CDFIs are rooted in their communities and have a deeply weaved knowledge of how their area should be empowered to make levelling up happen. By investing in the scale up of the CDFI sector, the Government can lever-up levelling-up.

CDFIs on the ground…

Well-Fed, Glasgow

Established in 2017, Well-Fed has expanded and grown from a community café to a home delivery service and commercial catering facility in Glasgow. Well-Fed helps people in the local community who are at risk of food insecurity and facing social isolation.

In 2020, Well-Fed was one of 20 social enterprise leaders to attend and complete CDFI Social Investment Scotland (SIS)’s Ambitions for Recovery programme. This programme offered support, mentoring, and coaching to help navigate the challenges of the COVID-19 pandemic, as well as looking towards recovery. Well-Fed also benefitted from £25,000 of Third Sector Resilience Funds, managed by SIS, and backed by the Scottish Government.

Chris Gray, Managing Director said:

‘Ambitions for Recovery gave me the confidence to enter contract negotiations and procurement discussions with Glasgow City Council, and we now provide catering services for hotels in the city that have been providing accommodation for homeless people during the pandemic. By providing 700 meals per day as part of this contracted work, we have been able to provide as many as 500 extra meals per day for people in the local community.’

Case study taken from SIS’s new impact report, available here.

Lucy, supported by Fair For You

Lucy (name changed) is a single working mum of three kids. When her ex-partner left several years ago, she was left with a lot of debt which was mostly in her name, despite being joint and household spending. This meant she could not get credit for other purchases.

She previously worked as a carer but developed sciatica. During lockdown last year, her back was particularly bad as she had an old, tired bed, worsening the pain. “With my back, all I can do is take painkillers but I don’t want to take too many.” She was advised to buy a new mattress – an unaffordable luxury until she discovered CDFI Fair for You:

“Since I came across Fair for You and got my new mattress, my back has been so much better. A better night’s sleep definitely means a better life,” she says. She has now got a new, home office-based job working with and advising older people, using some of the skills from her care work. Lucy says “I’ve always worked and I always want to. I’m not exactly comfortable, I am always living week-by-week.”

Lucy recently needed to replace the family car, and was able to do so through a hire purchase agreement – she thinks that having a Fair for You loan on her credit history has made this possible. “It’s like a domino effect, if you can get one thing sorted in your life then it sorts out another – but you never know what’s around the corner. People like me we just need a bit of a leg-up, we’re not lazy, we do want to work, we just need a helping hand at times.”

SGD 3D Printing, Nottingham

Sam Gribben set up SGD 3D Printing in 2018 after six years in the printing industry. Based in Nottingham, they provide a 3D printing and design service. The printing uses a range of different materials suitable to any application including recycled materials, helping individuals and businesses to reduce their carbon footprint.

Despite having an impressive portfolio of clients such as Network Rail, the 3D printing specialists needed funding to purchase new printing machinery to increase production and reduce manufacturing costs. A £51,000 investment from CDFI First Enterprise – Enterprise Loans has enabled them to be more competitively priced and target larger contracts.

Sam Gribben, founder and director, said:

“Without the funding from First Enterprise – Enterprise Loans, we wouldn’t have been able to invest in our new Formlabs SLS printer and diversify and expand SGD 3D as the first lockdowns affected orders. The new printer will allow us to print 10 times more items than our previous printers, allowing us to target more SMEs orders with larger print runs than individual hobbyist orders.”

[1] Longitudinal Small Business Surveys 2015 and 2019, Employers and Non-employers, Question G2.

[2] LSBS 2019, Table 82; SME Finance Monitor Q4 2019.

[3] Financial Conduct Authority: FCA finds the Covid-19 pandemic leaves over a quarter of UK adults with low financial resilience