Community Development Finance Institutions (CDFIs) are social enterprises providing affordable loans, money management and budgeting advice to households excluded from mainstream finance. They help people avoid exploitative, high cost and illegal credit providers, while improving the financial wellbeing of their customers. Since the onset of the Covid-19 crisis, millions more people have become financially vulnerable. CDFIs’ proactive and innovative response has been a lifeline for people facing financial hardship. This series of case studies shows how.

It’s always been clear to Sharon MacPherson, chief executive of Scotcash, a CDFI in Glasgow, that her customers are careful with money. “They might be excluded from mainstream financial services, but they’re exceptional at managing their budgets.” So when Covid-19 struck how did it affect customers – and what was the impact on Scotcash’s products and services?

It’s always been clear to Sharon MacPherson, chief executive of Scotcash, a CDFI in Glasgow, that her customers are careful with money. “They might be excluded from mainstream financial services, but they’re exceptional at managing their budgets.” So when Covid-19 struck how did it affect customers – and what was the impact on Scotcash’s products and services?

“There was an immediate and significant drop in demand in March,” says Sharon, “with applications reducing by around 70% and loans reducing by about half.” The affordable credit provider, established since 2007, was receiving 4,000 applications per month this time last year; now it’s 1,000, she says. Despite the drop in demand for credit, Scotcash was agile and offered other services to support its customers’ acute financial needs.

Flexible products

As it became clear the UK needed to enter lockdown and temporarily close much of the economy to address the crisis, there was an immediate increase in requests for payment holidays.

“Before the crisis less than five percent of customers sought payment holidays,” says Sharon. “When the crisis started, we communicated with all our customers – well before the FCA instructed credit providers to do so – and offered payment holidays. Around a third of customers are now doing so.”

While this was clearly the right thing for this ethical lender to do, and Sharon is proud her team were proactive in offering payment holidays early, there’s naturally been an impact on Scotcash’s income, with a big drop in loan repayments. And Sharon is concerned about the future impact on customers:

“Customers generally borrow from Scotcash in early summer and the run-up to Christmas,” says Sharon. “They’re really good at managing their money and don’t like to take on a loan unless it’s necessary. We’re worried that many people who’ve taken payment holidays now won’t have been able to pay off more than half of their existing loans if they need a loan again at the end of this year.”

Personalised support

Sharon and her staff spent a lot of time on the telephone with customers in April and May. A grant from Foundation Scotland gave Scotcash the means to make hardship awards of £50 each to 80 households, all existing customers. “Talking on the phone allowed us to do what we do best: help customers with their specific and overall financial circumstances,” she says.

“We identified eligible people for the hardship grants through these conversations, their requests for payment holidays, and by our team pinpointing vulnerable households which needed support. We used flexible criteria: our only key requirement was that customers had been ‘impacted by the crisis’ so there were all sorts of different circumstances: customers who had been furloughed and lost 20% of their income; others who had been made redundant; some whose household expenses had shot up because they were shielding and could only get groceries from more expensive places than normal.

“We had conversations with every single one of these households. We looked at their specific circumstances and we’d identified what support was available in each local authority area. Most customers didn’t know what help they could get from their local council, so they really valued us finding this for them. We told them about our online benefit checker tool too. There’s a big assumption that people on low incomes know everything they are entitled to, but they really don’t.”

Lockdown meant Scotcash could not give people face-to-face advice, though. “There are a cohort of customers who we know can’t use online services,” says Sharon, “so our loan officers were proactive in contacting them and helping them where necessary, building their confidence and digital skills.”

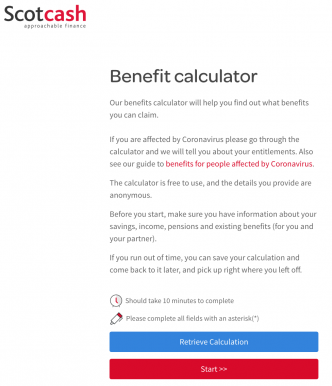

Online Benefits Checker

Alongside the human touch, Scotcash has used social media to continue spreading the word about its online benefits checking tool, especially in May and June. This was particularly helpful for people – whether Scotcash customers or not – who’d been newly made redundant during the crisis. They could identify any tax credits and other relevant benefits.

This had an enormous impact. In February, March and April there were 52 benefit checks made with the tool, identifying over £1,400 of benefits for users. But in May and June, 136 benefit checks were made and over £26,400-worth of benefits were identified through the tool by users. This puts money they are entitled to, but often don’t access, into their pockets and households–a lifeline at a time of unprecedented pressure, saving many the need to take on debt.

Scotcash had launched this online “Money MOT” service in 2018, initially as a one-year pilot. An independent evaluation found Scotcash “a pathfinder organisation in improving digital access to the services they offer.” It added that the learning would benefit other parts of the affordable credit sector and “improve individual financial capability and ultimately contribute to reducing reliance on illegal money lenders.”

Innovative products and partnerships

A new partnership with Snoop, a free money management app, launched in July 2020. This useful money-saving tool is being offered to everyone who applies to Scotcash for a loan, whether or not they are successful. It continues Scotcash’s long track record in effective partnership working. Collaborations with Money Advice Scotland, Glasgow CAB, and numerous local authorities and housing associations have all been effective thanks to a shared purpose between Scotcash and partners to support the most vulnerable.

High customer satisfaction

Customers’ feedback about Scotcash during lockdown remains exceptional, with participants in a customer survey making comments including “the Scotcash adviser was a joy to interact with, from start to finish she was incredibly helpful, friendly, positive and empathetic, and I cannot put into words how good the level of service offered to me was” and “the person I spoke with was beyond helpful, she went out her way to help me. Brilliant service.” 93% of customers described Scotcash’s services as very high or high quality.

Scotcash’s staff are clearly multi-skilled. This has been a great asset as the firm – a Community Interest Company – adapted to address the pandemic and lockdown. “There was no interruption whatsoever to our operations when we switched over to working from home” says Sharon.

“A couple of years ago, when the storm nicknamed the ‘Beast from the East’ caused havoc, we’d ensured every member of our team could work from home, investing in appropriate IT, equipment and processes, all compliant with data protection, cybersecurity and health and safety. That meant in March this year we could make the switch to home working in minutes. But we had to match our resources to our immediate drop in income and switched some staff to furlough. We ensured staff not furloughed could multitask, operating across advice, loans and administration functions: it’s been absolutely critical for us all to be able to take on a variety of roles.

“The situation has made us think about how we’ll use our offices in the future, and we’re discussing the experiences of working from home with our team. It’s something some staff love but others don’t enjoy, so we’re taking all views on board as we plan the future shape of the business.”

Local authority partners, politicians, policymakers, journalists, academics and funders frequently praise Scotcash for the difference its financial and wraparound services make to customers’ lives. Clearly this award-winning and resilient CDFI adapted fast to the demands of the unprecedented crisis of 2020. But can it weather the storm? 2018-19 had been a particularly strong year for Scotcash. It expanded across UK, increased both the number of affordable loans it made and its turnover by around 40%, and reduced its cost of delivering each loan by over a third. What now?

“We are completely committed to realising our growth ambitions across the UK,” says Sharon, “and we’d love to accelerate discussions about collaboration with other community development finance institutions. There’s so much we can support each other with. We’re pursuing opportunities to ‘digitise’ financial exclusion services, such as automated benefit checking, savings schemes, and promotion of budgeting apps like Snoop.”

But Sharon would “love to see a more strategic and joined up approach to financial inclusion across the UK. It’s fantastic to see the work of Fair4All, but the part of their £100m dormant account funding that’s come to Scotland isn’t going into financial inclusion – it’s gone to a youth fund. This is a UK strategic and structural issue and we should be responding in a strategic way; for me the starting point would be for all UK nations to be on the same page.

“There’s also still a lack of recognition by politicians and policymakers that community development finance institutions need and deserve grant support – it is expensive to offer fair and affordable finance to the financially excluded, and yet the work we do makes an enormous economic and social impact, saving communities millions in interest compared with high-cost loan providers. Our sector also still needs funding to build capacity and keep up with the pace of development in the commercial sectors.

“We’re proud of every pound we can save our customers, every pound we can help them to put into a savings account, and every way we can help make life fairer for them..”

What next?

- In 2019, personal lending CDFIs including Scotcash lent £24 million in 35,000 loans to individuals, helping them save over £7.5 million in interest payments compared to if they had gone to a high-cost lender. They engage with their customers meaningfully to give them access to products and services designed around what they need; to meet both their short-term needs and build their long-term wellbeing.

- We can supply journalists and media with a wide variety of case studies about how people, businesses and social enterprises have been supported thanks to Responsible Finance providers (community development finance institutions). We are also able to comment about access to finance, for businesses, social enterprises and households.