This month, for the first time the Financial Conduct Authority (FCA) released figures on the high-cost short-term credit market (HCSTC), and they paint a worrying picture.

HCSTC (usually in the form of a payday loan) has been increasing since 2016 despite a reduction in the number of lenders. £1.3 billion was lent in 5.4 million loans in the year to 30 June 2018[i]. In addition, recent estimates show that the loan shark industry is worth around £700million[ii]. People are increasingly turning to credit to meet the cost of essentials, and taking out small loans with unscrupulous lenders often leaves them heavily indebted.

The FCA’s figures show that five out of six HCSTC customers are working full time, and the majority live in rented properties or with parents[iii]. This points to two of the key drivers of UK poverty and demand for payday loans: jobs lacking decent pay, prospects or security[iv] and increasing housing costs[1]. The nature of the gig economy and zero hours contracts exacerbates the effects of low pay, and people are often driven to seek payday loans to make ends meet. This is in contrast to the common misconception that low-income people borrow in order to finance a lavish lifestyle.

The FCA has introduced significant reforms to the HCSTC market since 2014, and a total cap on credit was introduced in 2015. Despite this, low-income consumers often pay a premium for accessing credit, if they are able to access it at all.

In order to reduce reliance on high-cost short-term credit, banks should be required to provide appropriately costed services to individuals in deprived and low-income areas. At the same time, there needs to be more awareness around affordable alternative sources of credit, such as responsible finance providers. Responsible finance providers can support people who are unable to access credit from mainstream sources, but they need investment to help them scale and market themselves.

In 2018, personal lending responsible finance providers offered fair credit to individuals through 45,900 loans worth £26 million. They conducted robust affordability checks, routinely referred over-indebted applicants to debt advice services, and treated vulnerable customers with forbearance and flexibility.

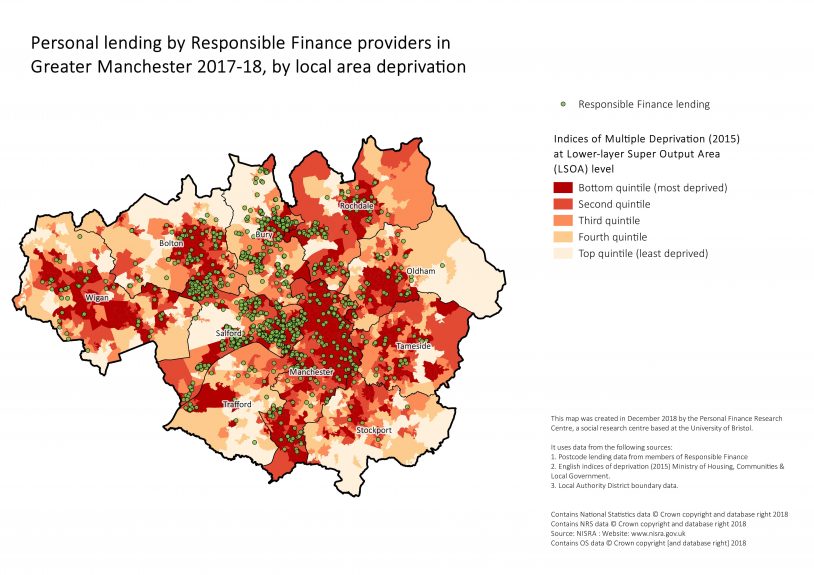

The map below shows responsible finance personal lending in Greater Manchester in 2018 overlaid with local area deprivation. It shows how responsible finance providers make loans heavily concentrated in the most deprived areas – areas which are often targeted by exploitative lenders and loan sharks.

The map signifies the building of financial resilience in low-income communities. In 2018, the industry helped almost 15,000 people pay bills, existing debts, and for emergencies. 23,000 of its customers had used a high cost lender in the past year.

One example of this is Sophie, who approached responsible finance provider Lancashire Community Finance (LCF) after she had entered a contract with a well-known rent-to-own store for a new TV after hers broke down. The contract would have cost her over £1,825.20 over 3 years which she soon realised she could not pay back. LCF advised her to return the TV immediately as she was still in the cooling off period. They helped her find an equivalent one online from a retailer for £419, and lent her £400 with repayments over 78 weeks totalling £699.66, saving her £1,125.54.

Responsible finance providers play a critical role in supporting local economies across the UK but their growth is hampered by a lack of available capital for investment. This must now be remedied to give more communities across the UK a fairer, more affordable choice about where they can access credit.

To learn more about the impact of the responsible finance

industry in 2018 please read our annual

report.

[1] A

recent report found that average housing costs for low-income families with

children have risen four times faster than for middle-income families – https://www.insidehousing.co.uk/news/news/ifs-rising-affordable-rents-have-driven-increase-in-poverty-56879

[i] https://www.fca.org.uk/data/consumer-credit-high-cost-short-term-credit-lending-data-jan-2019

[ii] https://www.mirror.co.uk/news/uk-news/voice-people-crackdown-uk-loan-13700702

[iii] https://www.fca.org.uk/data/consumer-credit-high-cost-short-term-credit-lending-data-jan-2019