02.01.2018

With generous funding from the City of London Corporation’s charitable funder, City Bridge Trust, in 2015 Responsible Finance was able to work with two responsible finance providers in London to pilot local partnership models aimed at tackling financial exclusion. The independent evaluation recently completed by the New Economics Foundation (NEF) provides learning relevant to those wishing to try this approach in other parts of London and across the UK.

Approaches to tackling financial exclusion are often fragmented, with no one organisation tasked to pull together a range of advice and support while also facilitating access to appropriate and affordable financial services. This project considered how partnership working between a wide-range of organisations could tackle this providing holistic support for the most financially excluded.

The pilot was led by project partners Fair Finance (East London) and The London Small Business Centre (East & South East London).

Fair Finance is a social business that offers a range of financial products and services to meet the needs of people who are financially excluded. The focus of its partnership pilot was personal finance.

The London Small Business Centre delivers events, workshops and other activities focusing on startup and growth for SMEs. Its partnership pilot aimed at supporting young entrepreneurs.

The overall goal of the partnerships was to adopt a holistic approach to provide scalable alternative financial services systems, unlocking greater access and choice for people and businesses across the UK, thus reducing financial exclusion. Financial exclusion in the UK remains a significant challenge; many people lack access to the financial services essential to modern life, or do not have the skills and ability to use and benefit from these services.

The project partners integrated their services as a means of strengthening local communities by:

- Converting latent community needs into tangible demand for community finance

- Boosting the supply of new capital to these areas

- Creating a new generation of community enterprise

- Building community skills, knowledge and confidence to ensure inclusion of the less obviously sustainable organisations

- Creating collaborative advantage.

Fair Finance Delivery Model

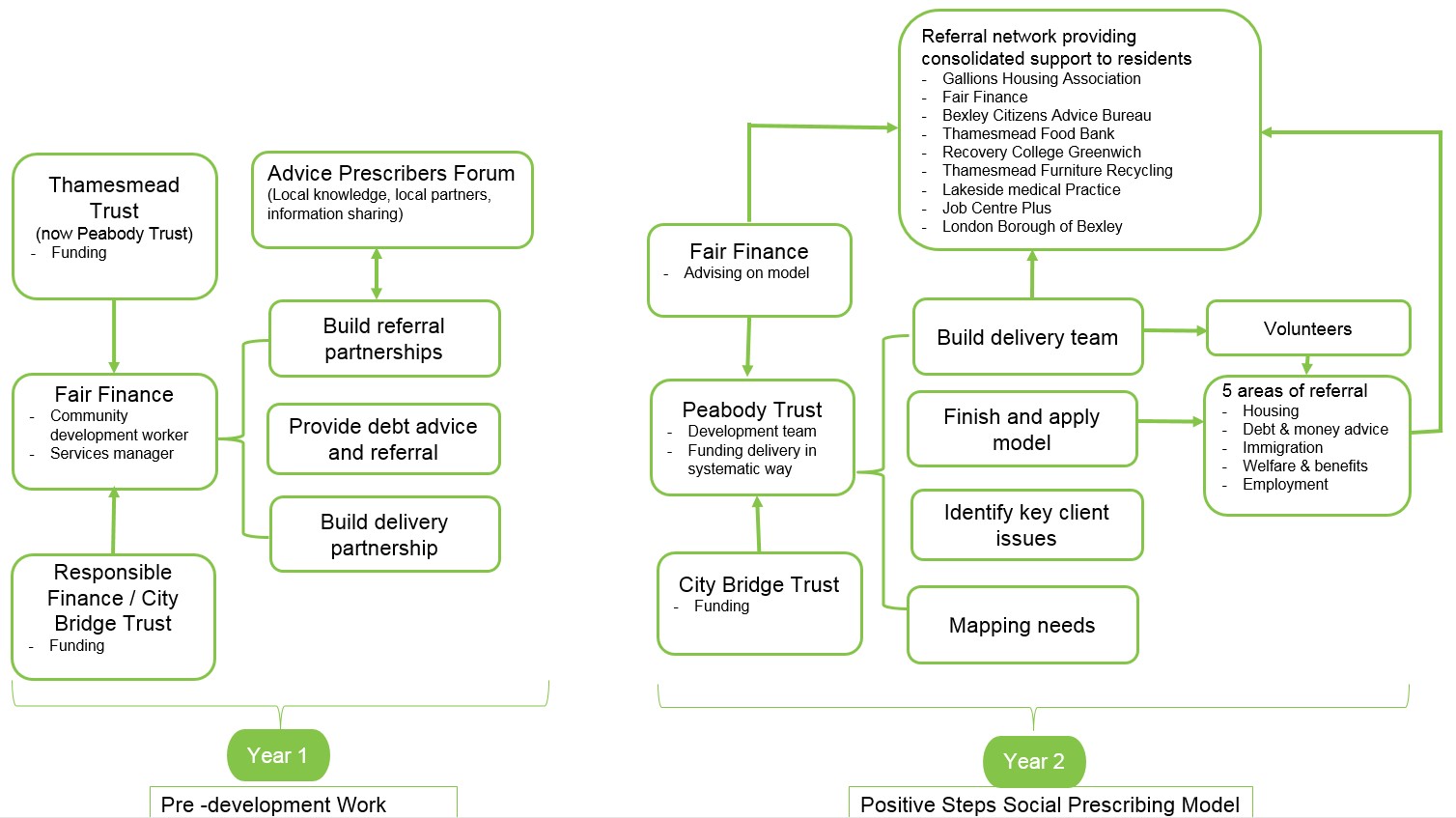

In the first ‘pre-development’ phase, Fair Finance drove their model’s development, building a referral partnership of local organisations which referred clients to Fair Finance and other members of the network.

In the second year, the model developed into Positive Steps, a social prescribing model reliant on partner cross-referral. The model relies on the proximity of partner organisations. In this, as shown in the graphic below, the referral network has five core areas of referral, monitored by five core partners, with data collected for other referrals.

As part of the pilot, Fair Finance partnered with local GP surgeries to create a referral programme. One individual was left with a large, unmanageable debt after the death of her husband. The stress and isolation of her situation led to the rapid deterioration of her mental health, at which point her GP referred her to Fair Finance. The end result was her debt being released due to a debt relief order. When asked what would have happened without the support she had received, she said that she may have ended her own life.

Recommendations

The key factors determining the success and future sustainability of Community Finance Partnerships were identified from the pilot as:

- The availability of adequate financial and staffing resources

- The level of commitment from partners and the continuous exchange of knowledge and information

- The presence of a central body providing strong guidance, coordination and leadership

- The development of outcomes framework to monitor and evaluate the impact of the partnership, implemented at the beginning.

From the pilot, NEF developed a useful management and modelling tool based on the Theory of Change, which can be used by those wishing to adopt a partnership model as an indicative pathway of change. The tool can be accessed in the report.

It must be noted that the complex barriers to financial inclusion mean that individuals sometimes move in and out of financial exclusion repeatedly over their lifetime, either temporarily or for the long-term. The process of moving from exclusion to inclusion can take a long-time and a holistic range of support, tailored to each individual. Due to this, partnerships must be consistent, long-term and well-resourced to have a lasting and evidenced impact on communities. Nevertheless, they can have real impact. For example in reducing stress of local GPs by ensuring that debt related stress is tackled by debt experts rather than health experts.

As many households are placed under further financial stress by the rising cost of living and stagnating incomes, we would encourage local authorities, working with responsible finance providers and others to consider this model. With long term commitment, it could prove really effective in tackling financial exclusion and building financial resilience.

For further information please see the report summary, available here.