A practical toolkit for local finance partnerships

26.10.2017

Partnerships between local finance organisations have many benefits, evidenced by existing collaborations between some responsible finance organisations. The ‘Creating Local Finance Partnerships Toolkit’ was created as a practical guide to facilitating partnership working from the set up to ongoing management and tracking outcomes, and can be accessed here.

Is a local finance partnership for you?

Partnerships between local finance organisations are usually formed with the goal of overcoming a particular gap in the market or expanding your market reach, so the toolkit begins by helping you assess whether a partnership is the best route to go down.

It is at this point that local stakeholders should be mapped out and approached. Once identified, the first key hurdle is organising the collaboration of the right people from the right organisations.

Partnerships have been found to benefit organisations as well as consumers; this must be emphasised from the get-go to structure win-win arrangements. An analysis on the benefits of partnership can be seen in our research, Tackling Financial Exclusion Through Local Finance Partnerships.

How should the partnership be structured?

Once you have assessed whether a partnership is the right route to go down and found a suitable partner(s), developing an appropriate structure and products is the next step.

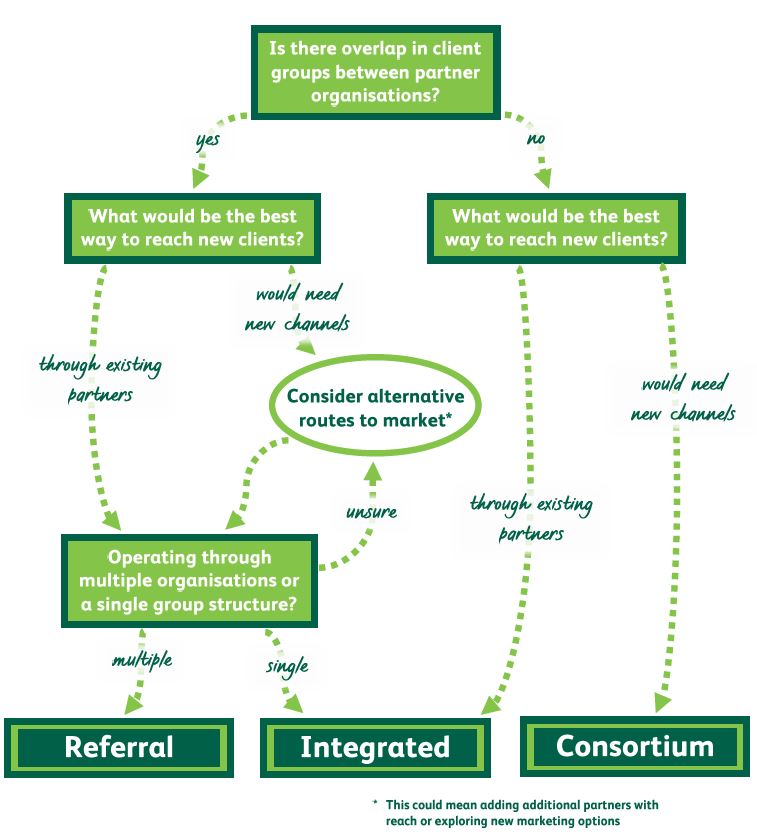

The structure and products should reflect the partnership’s purpose, and therefore must be set up in a way that generates the most tangible consumer benefit. The toolkit points to some key driving considerations, such as whether the customer needs access to multiple products at once, and whether a full or partial co-location required. Depending on these, there are three broad structural models that can be utilised. The toolkit provides the details of these models, and features a ‘decision tree’ which can be followed to guide the process, shown below:

Partnership Management – Who, How and What?

Who – The partnership lead, whether external or from one of the partner organisations, must exhibit independence in the role of partnership management.

How – All the partnership organisations should enter into a formal agreement, in order to codify their roles, operating expectations and how to measure success. A key strategic consideration is the funding of a partnership, where focus should be heavily placed on its sustainability. Seed funding is used to cover set-up costs; however many partnerships are largely self-funded.

What – The set-up logistics must be managed once a partnership is formed. This includes establishing a governance structure, commissioning new technology, establishing a marketing strategy, and setting partnership guidelines and expectations.

One of our members, Glasgow-based responsible loan fund Scotcash, is an example of a successful partnership model. It’s partner organisations provide a range of products to consumers in-house, including Glasgow Citizens Advice Bureau who deliver money advice, and Home Energy Scotland who offer energy advice.

Their partnership model immediately gives their consumers greater choice and accessibility than if these organisations were not co-located. As a result, Scotcash has saved them over £5 million in interest repayments, and helped them to collectively gain £5.5 million by enabling them to claim benefits they did not know they were entitled to, and renegotiate debts.

Despite the various challenges in working with other organisations, Scotcash say that their successful partnerships are driven by the shared mission of improving consumer’s financial wellbeing and capability and their clear niche in service provision.

Local finance organisations are expert in responding to local need and have at their core a mission to improve their customers’ financial health. We believe that the partnership of such organisations can offer an exciting and fruitful ventures to advance communities and participating organisations alike.

More information is available in the toolkit and our in-depth research at the links below.

Creating Local Finance Partnerships

August 2017

This toolkit sets out the steps involved and the factors to consider when setting up a local finance partnership.

Tackling Financial Exclusion Through Local Finance Partnerships

May 2017

This report examines what makes a successful local finance partnership, and how these can be replicated to tackle financial exclusion across the UK. The report draws on experience from the UK and USA.