Finance is reaching deprived neighbourhoods unserved by banks, new research shows

Finance is reaching deprived neighbourhoods unserved by banks, new research shows

01.12.2014

Community-focused alternative lenders have contributed over half a billion pounds to UK GDP, according to new research from the Community Development Finance Association (CDFA), released today. The lenders have responded to increased demand for non-bank finance, and in the process helped to create 11,500 new businesses, supported over 20,000 jobs and aided 42,000 people avoid high-cost credit.

The alternative lenders – known as community development finance institutions (CDFIs) – are social businesses that provide fair, affordable credit to consumers and enterprises, and are the focus of the CDFA’s ‘Inside Community Finance’ report.

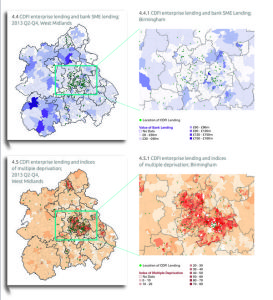

‘Inside Community Finance’ maps CDFI lending against bank lending, and clearly shows for the first time how these alternative lenders are serving the neighbourhoods where banks aren’t lending. These are also the UK’s most deprived areas.

The maps can be seen here.

Ben Hughes, Chief Executive of the CDFA said:

“The role of CDFIs in reaching underserved communities is indisputable. They are not only helping customers denied access to mainstream finance, they are pumping millions back into Britain’s economy.”

“CDFIs are bringing diversity, and values, back to the financial services industry, and their reach is growing. This year CDFIs made over 55,000 loans and since the 2009 recession have lent over £1 billion. Built on sustainable, ethical and entrepreneurial principles, CDFIs are increasing the wealth and prosperity of Britons everywhere.”

CDFIs are helping business owners like Andy Savery, who has grown his commercial truck body building business and doubled his workforce after taking a CDFI loan. And consumers like David and Moira who took a loan to get a car that was adapted to their disabilities transforming their mobility.

‘Inside Community Finance’ is available for download here.

Additional information:

- The Economic Impact Tool (EIT), developed over the past year by the CDFA with support from Citi, quantifies CDFIs’ contribution to the UK economy in monetary terms. The EIT shows that CDFI lending to SMEs contributed over £500m to the UK economy, illustrating the difference CDFI lending makes to communities.

The CDFA has produced maps to compare CDFI postcode lending data, the British Bankers’ Association’s voluntary bank lending data, and the 2010 English Indices of Multiple Deprivation). Maps are available of SME lending in the West Midlands region and personal lending in Greater London.

The Community Development Finance Association (CDFA) is the voice for providers of fair and affordable finance. We represent and support a national network of community development finance institutions (CDFIs). Our mission is to support the development of a thriving and sustainable CDFI industry that provides finance for disadvantaged and underserved communities, bringing wealth, well-being and economic prosperity to these areas.