How CDFIs are doing more with less

How CDFIs are doing more with less

22.04.2014

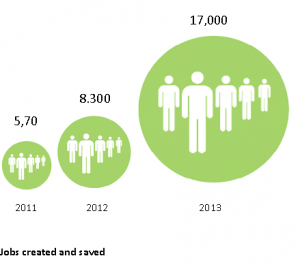

The impact of CDFIs has grown massively in recent years. The jobs created and saved thanks to CDFIs have more than doubled in just one year.

From nurseries and hotels, to window fitters and web designers, thousands of businesses have been started with finance and advice from a community development finance institution (CDFI). In 2013, almost 10,000 small and social businesses were able to start and grow with a CDFI loan. They created and saved over 17,000 jobs, many in our most disadvantaged neighbourhoods. As well as jobs, they’re bringing skills, aspiration and prosperity, and of course new goods and services.

They are supporting businesses that are leading the way in revitalising high streets.

Enterprise Answers, for example, invested in Moo Bar, an artisan experience bringing the taste of microbreweries to Penrith. In the process Moo Bar brought an old listed building back to life and created 15 jobs for the local area.

And Key Fund invested in Bird Cage, a boutique craft charity shop which transformed a quiet part of Skipton High Street into a must go destination. It attracted other retailers to the area, developed the skills of volunteers as well as generating income for a charity combatting domestic violence.

CDFIs are also supporting local economies by helping families avoid high cost credit. Last year CDFIs helped 40,000 people with responsible and affordable personal loans. Using CDFI loans rather than doorstep loans saved these customers a combined £7.8million in interest payments. That’s £7.8million that can be spent in the local economy, on food, rent and other essentials.

These are some of the findings from the CDFA’s recent Inside Community Finance publication, based on a survey of CDFA members. Supported by Unity Trust Bank, the leading bank investor in CDFIs, Inside Community Finance unpicks how CDFIs are doing more with less, to deliver ethical finance that achieves social and economic change.

But CDFIs are only able to meet a tiny proportion of the estimated £6billion of demand for their kind of finance. Just imagine what could be achieved with a well-supported CDFI industry that is able to invest in its infrastructure, outreach and growth. If CDFIs had the marketing budget of the payday lending industry the consumer and business finance landscape would be diverse, fair and focused on the needs of the customer. As it should be.

Sam Collin

Communications Manager, CDFA

Read more about the work of CDFIs