05.07.2012

CDFIs fill the finance gap for businesses in need, according to a new survey of community finance providers published today.

Community Development Finance Institutions (CDFIs) lend to businesses in disadvantaged communities, and increasingly, to businesses no longer successful in securing finance from mainstream commercial institutions such as banks. Now a new “state of the sector” survey, Inside Community Finance, demonstrates their remarkable impact as the “unsung heroes” of business finance provision.

CDFIs focus on the business markets that banks find hardest to reach: start-ups, sole traders, informal and unincorporated ventures, and micro-enterprises employing fewer than ten staff. Collectively, these make up 95% of the UK’s businesses. More recently some larger smes have sought community finance as they too face challenges in securing bank credit.

There are many reasons why a viable business might be unsuccessful at securing credit from a bank, such as:

- Amount of finance required too small to be cost effective for banks to service,

- Little or no collateral security to guarantee debt,

- Insufficient business track record

- Poor credit rating or history

- Coming from or operating in an underserved or deprived community.

By investing in businesses in disadvantaged communities or struggling to access mainstream credit, CDFIs help to bring employment opportunities and needed services to deprived communities.

Business size

Of the 1500 business loans made last year, 82% went to microenterprises. Of the 1240 loans to micros, nearly 700 went to sole traders – proprietorships owned and run by one person – which represent three-quarters of all British businesses. Operationally small and having low turnover, sole-traders are particularly expensive and difficult to serve from a bank perspective, but are well-served by CDFIs. The remaining 540 loans to microenterprises went to those employing as many as nine employees. 260 loans – 18% of the total – were made to SMEs, businesses with between 10 and 249 employees.

Start-up and existing business

Start-up enterprises – with relatively high failure rates, little track record and fewer assets to offer as loan collateral than established businesses – are particularly risky to mainstream lenders. CDFIs serve budding entrepreneurs well. Of the 1500 business loans made last year, nearly half – 725 – were made to start-ups. More than half of microenterprise loans (55%) and 16% of SME loans went to start-up businesses.

Referrals

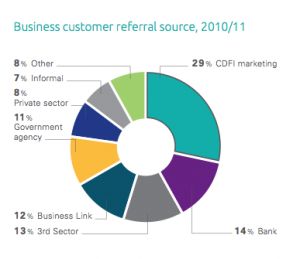

CDFIs’ own marketing activities accounted for nearly 30% of business customers. The remainder of customers served were referred from a variety of sources, with banks accounting for 14%.

CDFIs’ own marketing activities accounted for nearly 30% of business customers. The remainder of customers served were referred from a variety of sources, with banks accounting for 14%.

Although banks are the most obviously placed to refer customers to CDFIs, the current bank referral system consists of only a few ad hoc arrangements between local bank branches and neighbouring CDFIs. A national scheme is currently under development by the CDFA and British Bankers Association.

Growth in CDFI business loan portfolio

CDFIs reported having 5,675 customers with outstanding business loans as at 31 March 2011, a 22% increase over the previous year.

Average loan sizes

CDFIs reported providing an average loan size of £11,300 to microenterprises, with a range between £500 and £37,000. For SMEs, the average loan size was £37,000, with a range of £12,500 to £92,000.

Cost of credit; collateral

The average annual percentage rate (APR) charged by CDFIs last year for loans to microenterprises was 14%. The average APR charged to SMEs is similar, at 13%. Last year nearly 30% of loans CDFIs made to businesses were unsecured.

The future of CDFI finance for business and microenterprise

Inside Community Finance offers significant further detail and data regarding CDFIs delivering finance to business and microenterprise, including analysis of their capital and revenue requirements.

Three recent policies intended to boost lending to business are worth noting:

Enterprise Finance Guarantee

The Enterprise Finance Guarantee (EFG) is a government scheme intended to facilitate lending to viable SMEs lacking adequate security for a commercial loan. Despite this apparent fit with the CDFI customer base, the seven CDFIs that actively participated in the scheme last year found EFG more suited to SME rather than microenterprise customers. EFG has seemingly done little to enable lending to microenterprises.

Harry Glavan, CDFA’s head of policy and communications, and the author of the report, says

“A scheme recognising the risk of lending to microenterprises and tailored to the needs of those institutions specialising in serving microenterprise markets would go far in facilitating additional lending to viable yet severely underserved businesses.”

Community Investment Tax Relief

Business lending CDFIs require revenue to cover operation costs as well as capital to lend to customers. The overall capital that CDFIs secure to onlend is increased through recycling funds: as loans are repaid, they are re-loaned to other businesses in need of support. Clearly, without capital to onlend, CDFIs cannot meet business finance demand.

Last year 36 business lenders reported receiving about 20% less new capital than the previous year. Taking on investment in the form of bank loans to raise capital has become increasingly important: bank loans accounted for over a quarter of the total raised, and of this, three quarters was raised using Community Investment Tax Relief (CITR), a government tax relief scheme designed to encourage private investment into CDFIs as capital to onlend to enterprises in disadvantaged communities. Harry Glavan comments that:

“CITR must not only be retained but retooled. Ten years of experience with the current scheme has provided a wealth of insight into what does and doesn’t work as well as what is required to ensure that more than a minority of CDFIs participate in the scheme and that they are able to successfully attract investors, thereby realising the dream envisioned by the scheme’s architects that CITR would raise hundreds of millions of pounds in private investment.”

The Regional Growth Fund

From July 2012 the BIs-sponsored CDFA Regional Growth Fund programme will provide £60m in capital investment over five years to thirteen CDFIs. As important as this funding is, it cannot itself redress the dearth of capital available to onlend to businesses unable to access mainstream credit. For this, it is estimated that upwards of £1bn could be effectively utilised in expanding the provision of community finance for businesses across the UK.

CDFA suggests policy changes and new structural and funding frameworks to redress gaps in the market, so that existing CDFIs can expand and new CDFIs launch where none exist, creating a more just financial system where access to fair and affordable credit is a given right for all UK businesses, civil society organisations and households.

What next?

- download Inside Community Finance (pdf, 68pp, 790kb)

- Ben Hughes, chief executive of the CDFA, and Harry Glavan, head of policy and communications, are available for interview / comment. Contact Sam Collin, Communications Officer [email protected], 020 7430 0222 x207

- Read about CDFA’s JUST Finance campaign for more support and growth for the ‘Unsung Heroes’ of the finance sector and get involved easily yourself